|

|

Cyber Security & ID Theft

Protect Your Identity

By clicking the above links, you will leave this website and be redirected to a third party site. The mere fact that there is a link between this web site and another does not constitute a product or program endorsement by Norristown Bell Credit Union or any of its employees. Norristown Bell Credit Union has no responsibility for content of the web sites found at these links, or beyond, and does not attest to the accuracy or propriety of any information located there. Privacy and security policies on the third party website may differ from those practiced by Norristown Bell Credit Union. The credit union does not represent either the third party or the member if the two enter into a transaction.

New Payment Technology 101

How we pay for things is changing every day. Education is an important step to understanding how these changes can affect our daily lives. Here are a few of the payment methods hitting the market today:

What is EMV?

- EMV stands for Europay, MasterCard, and Visa, the founders of the chip technology standards.

- Chip cards, or ‘smart cards’, have embedded microprocessors in the form of a small metallic "chip" that is visible on the front of the card that provides strong transaction security protection that aren’t possible with traditional magnetic stripe cards.

- While this technology can't prevent all security breaches, the chip was designed to prevent counterfeit fraud, where the criminal creates a duplicate plastic card.

- There will be a slot at the bottom of most merchant terminals – this is where you will be able to insert the card and hold it there until the transaction is complete.

- NBCU is looking to offer this EMV technology later this year.

What is ApplePay?

- Apple’s new payment service will enable shoppers to buy items at merchants who have machines capable of reading the near-field

communication radio signal (NFC) that makes Apple Pay work. And only Apple’s newest phones, the iPhone 6 and iPhone 6 Plus, include the technology. communication radio signal (NFC) that makes Apple Pay work. And only Apple’s newest phones, the iPhone 6 and iPhone 6 Plus, include the technology.

- Apple Pay requires a consumer to register a credit card—either by taking a photo of a card or authorizing one already stored on Apple’s iTunes. Then, the shopper can make purchases using his/her fingerprint on the Touch ID reader.

- Apple Pay encrypts each transaction with a distinctive code that can only be used once, a security feature that protects consumers’ personal information from being stolen as it is transmitted through a retailer’s network, or from the retailer’s central database.

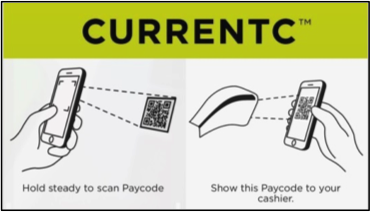

What is CurrentC?

- A company called MCX (Merchant Customer Exchange), spearheaded by Walmart, was started to build a mobile payment solution called CurrentC.

- CurrentC uses QR code technology. A QR code is a ‘Quick Response Code’ that contains a type of matrix or two-dimensional barcode.

- When it’s time for a user to check out, they request to pay with CurrentC. The consumer then unlocks their phone, opens the CurrentC app, opens the code scanner, and scans the QR code shown on the cashier’s screen. The reverse may also occur where the consumer’s app displays a payment code and the cashier scans it.

- The system is also designed to automatically apply discounts, store loyalty programs, and charge purchases to a variety of payment methods (bank account, credit card, etc) without passing sensitive financial data to the merchant.

- The terms of service agreement leaves high liability for fraud to the user if someone else is able to get access to a user’s phone and make CurrentC payments.

Mobile Safety Tips For Consumer Awareness!!

The mobile phone is quickly becoming a part of every person’s life. We've come to rely on our smartphones for many things; whether we're finding friends on social networks, looking up restaurant reviews or remotely turning off the lights in our homes. But as a growing number of Americans begin using their smartphones for mobile banking, experts warn that consumers should be cognizant of the dangers in using these devices to manage their finances. Consumers should be aware of the possible dangers to their phones and their money, and take steps to protect themselves and their accounts. Here are several potential weak spots of mobile banking and how to beat them.

Thanks in part to the growing numbers of financial institutions offering apps to their customers/members, the number of people using a financial services mobile app is for the first time surpassing the number of people doing their banking with a mobile browser. This is good news because mobile banking apps tend to be more secure than mobile browsers. Apps have built in security features that can't be built into mobile browsers. The bottom line: If your financial institution (and NBCU does) has an app that you think is trustworthy, use it instead of a browser for your mobile banking.

Any discussion about the use of mobile devices must include a discussion about the continued growth in malware; software programs like spyware, trojan horses and worms that are designed to damage or interfere with normal computer functions. In the past, most malware attacks have focused on computers. But in our current environment, malware on smartphones has exploded. Users should remember that their phones are like computers, except even more personal because they carry their phones with them all the time. Mobile phone owners should install antivirus software and use it on a regular basis. There are some apps that masquerade as your financial institution’s mobile banking app. These fake apps can steal a user's credentials or intercept security codes. Rogue apps are especially prevalent in third-party app stores, so users should download mobile banking apps only through the iTunes app store or Android's Play Store, and check closely before downloading to see if the app developer is your financial institution or other reputable app developer.

Consumers need to educate and re-educate themselves about online safety in a mobile world. We've learned over time on our laptops not to open certain files or click on links from people we don't know and for smartphones, we must understand these are computers, too. Beware of the risks. Many locations offer free Wi-Fi. And yes, that's great because by using it, users can escape potential charges based on their data plan. But mobile banking on Wi-Fi, particularly if it's free and unprotected Wi-Fi, creates danger because it's easier for criminals to access information on an open Wi-Fi network than on your 4G or LTE data network. If a consumer wants to conduct mobile banking over a Wi-Fi connection, the user also should consider installing a virtual private network, or VPN. On your computer at home, you're on your home network, and perhaps there is less risk that someone is monitoring your traffic, but when you're on your smartphone, you could be using it from an unprotected provider. It's important to know that not all Wi-Fi is safe.

People that don't use a password or a PIN to lock their phones or tablets, are at risk. If you lose your phone or even just leave it unattended briefly, someone can easily access its’ mobile banking app. Use strong passwords, not only for the device itself but also for the mobile app.

Additionally, it is suggested not to auto-save your login information by letting your phone remember your login information and password. The added security of typing in a password every time you use your phone or app is worth it.

When choosing that PIN or password, be sure it's hard to guess. Make every effort to check your account on a frequent basis to protect yourself. If you use multiple banking apps, it is suggested that one use a different password for each one, and be sure to log off after each session. It is smart to use "multifactor authentication" if your banking app offers it (and NBCU does), meaning that in addition to your password, there's an extra security step to protect your identity. Some suggest that you clean your phone screen regularly, so thieves can't see the smudge marks your fingers leave and guess your pass code.

Be Alert! Be Aware! Stay Educated!

Thanks for visiting nbcu.org.

Stop

by soon for some important announcements about new products and

services! |

|